Refugees often struggle to earn steady incomes and meet basic needs. The benefits of increasing savings for vulnerable communities are well documented. Research shows that having increasing savings and access to cash enables refugees to invest more in productive activities such as starting businesses, strengthens their resilience to shocks, and even increases their access to healthcare and education. Leaf aims to profoundly change the lives of refugees and migrants around the world, who can now both move securely with their money and save more money, empowering them to invest in their future, often for the first time.

Leaf can also be used for international remittances so that refugees’ friends and family are not charged exorbitantly high transfer rates when sending money home. In the process of using Leaf, customers will create a documented biometric and economic identity that they can use it to establish themselves in a new country. In addition to Leaf’s existing functionality, we will grow with our customers by offering micro-loans to users who have never had access to credit to start businesses and generate income. Leaf is designed to economically support refugees at each phase of their journey, empowering them to have financial security and freedom.

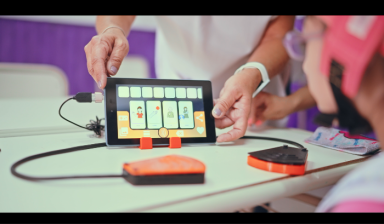

Many refugees rely on remittances but lack a way to receive them safely. Point-to-point cash transfer companies are often the only option for sending money across borders but charge up to 20% in fees and still leave the refugee carrying cash. Despite the high fees and inconvenience of having to pick up cash, most refugees still default to this option when receiving remittances because they know of no other way to get money across borders. Leaf is able to provide a digital solution for storing and transferring value without requiring a smartphone or charging prohibitive fees.

Related Stories

AGUA: Revolutionizing Global Collaboration for Funding Transparency (with Growth Graduate Atix Labs)