To this end, the UNICEF Venture Fund is building on its track record of action and engagement with the tech industry. The Fund is tracking emerging trends and identifying new areas for exploration, technologies, and applications of technology that can support UNICEF’s programmes through in-vestments in startups and Country Office projects. The purpose is to make early-stage investments into new solutions and foster them to become fundamental Open Source platforms that can be used for multiple purposes.

This report covers the high-level priorities and outcomes in 2021/2022, provides a deep dive into how solutions are accelerating results in UNICEF programme countries, and reflects on the learnings from the past year and priorities going forward.

In the past year, the Fund has:

-

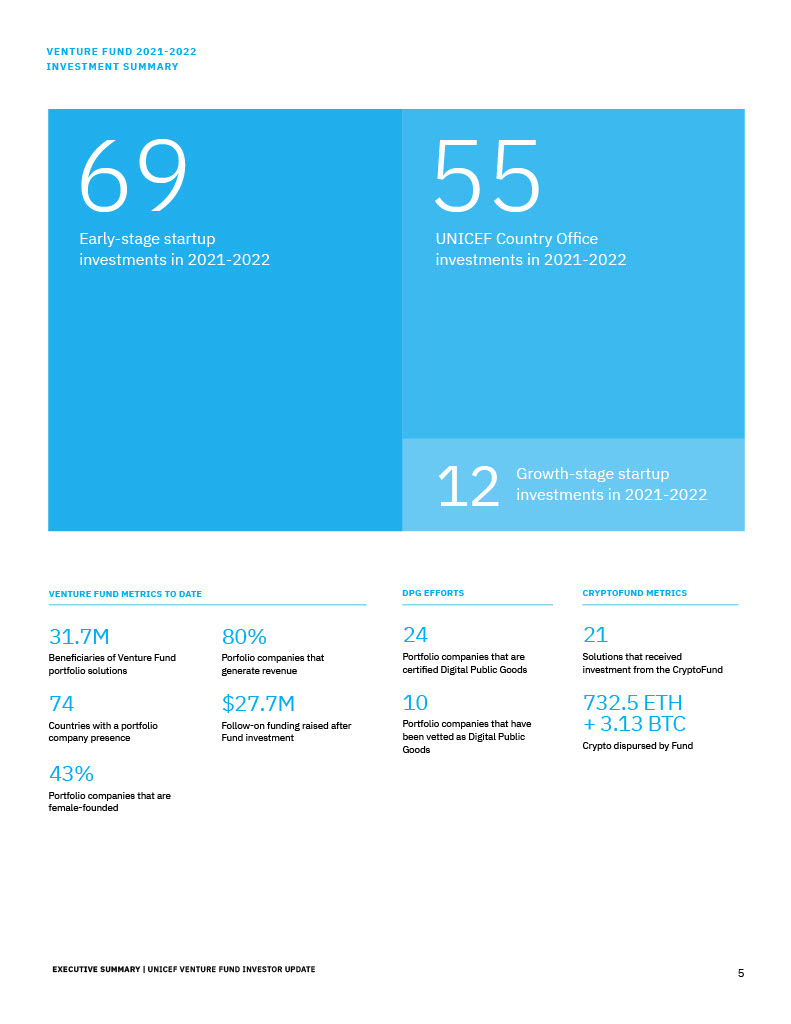

Invested in locally developed solutions from emerging and developing markets. In 2021-2022, the Fund made 69 investments in early-stage startups, 12 investments in growth-stage solutions, and 55 investments in UNICEF Country Offices. In total, reaching 74 countries. This work includes exploring blockchain to improve financial inclusion and leveraging big data to ensure access to and delivery of services for every child.

In addition to providing this seed funding to the very exploratory stage, in December 2021, the Fund launched its growth funding strategy to accelerate innovations and directly support country offices to use these solutions for their programmers. The 12 companies that received growth funding, will scale to 25 new countries over the funding period–all through the close collaboration with UNICEF Country Offices. One such example is Thinking Machine, a data intelligence platform from the Philippines, a company that is working to scale across 9 countries in Southeast Asia. -

Reached a total of 31.7 million beneficiaries across several industries. We are shifting the global balance and supporting entrepreneurs and technologists in emerging markets, especially female leaders. Our port-folio is now comprised of 43% female founders and we’re working hard to ensure we reach our goal of 50%.

-

Diversified funding flows and has driven private capital towards innovations for children – 80% of the companies in our portfolio generate revenue and have raised over USD $27.7 million dollars of investment after our seed funding.

-

Evolved new practices – the first of its kind, and the only mechanism in the UN system that can hold or disburse cryptocurrency (currently, Ether and Bitcoin). This year, the CryptoFund disbursed 732.5 ETH +3.13 BTC, and supported 21 projects. We’re working with various divisions across the organization with the goal of institutionalizing the CryptoFund, as its prototype period comes to an end in December this year.

-

Built a pipeline of vetted Open Source solutions that are more scalable, more adaptable, and accessible. From the Fund’s portfolio, 10 solutions have been vetted as Digital Public Goods (DPGs) and another 24 are DPG nominees representing a significant pipeline of solutions for the Digital Public Goods Alliance’s registry across the SDGs.

Complementing the innovation portfolio management strategy, the UNICEF Venture Fund is one of the key vehicles for the Office of Innovation to meet the complex, interconnected demands and explore the space of emerging solutions. Over the past year, there has been greater alignment in the the-matic focus of the Fund and nine portfolios and hubs. The core motivation of the Fund remains identification of “clusters” or portfolios of initiatives around emerging technology - so that UNICEF can both shape markets and also learn about and guide these technologies to benefit children.

Download the full report.

Related Stories