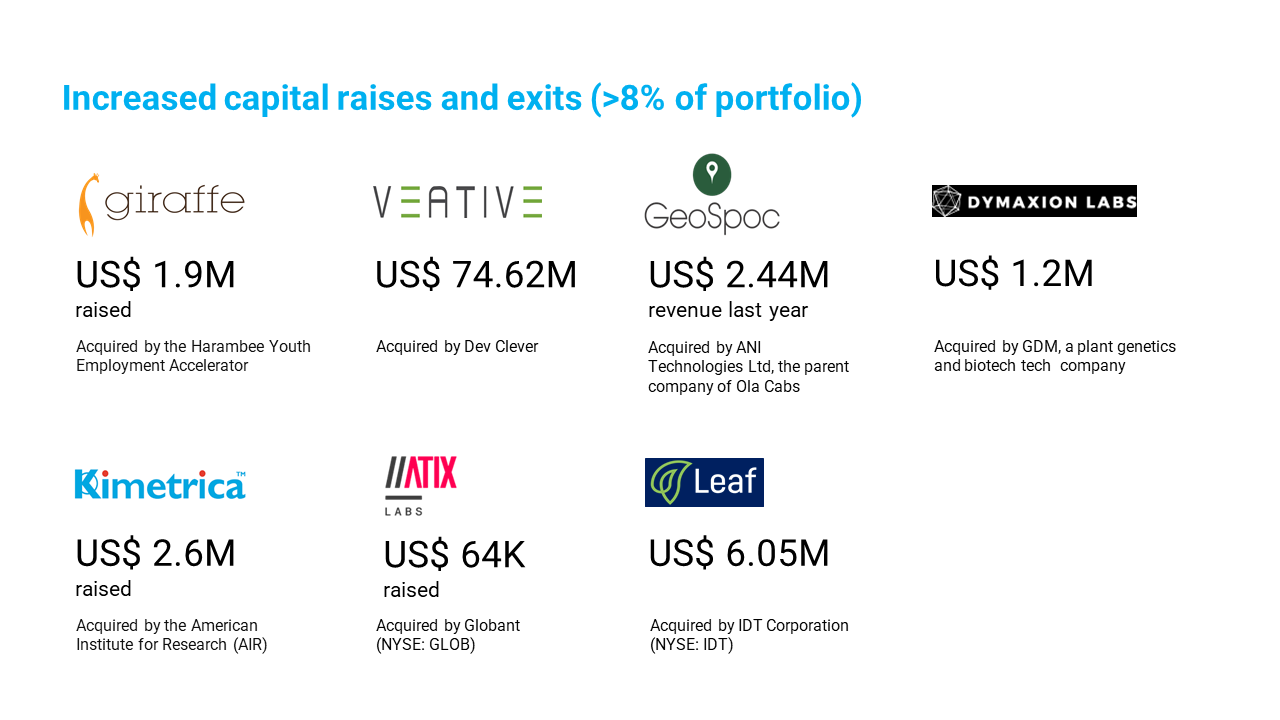

Today, we confirm this was not just a lofty dream. The Venture Fund has become a source of investable opportunities from new markets, led by diverse founders and generating above market financial performance and returns - all while accelerating results for children.

The companies supported by the Venture Fund score high on innovation and in breaking new ground. Somleng developed an alternative solution at 5% the cost of the market solution. Cloudline was the first airship to carry a payload of 10 kgs over 50 kms. Kimetrica developed an AI model that can predict children’s malnutrition at 60% accuracy from a single photo, providing a viable alternative to traditional methods which require more time, trained staff, bulky equipment, and physical handling of the child. Weni transformed the natural language processing landscape by engaging languages that even giant platforms, like Google Translator, do not accept. Statwig developed a unique solution that captures data across supply chains, unlike other solutions, by acting as middleware and pulling data from several sources to provide a powerful platform to track all segments of the supply chains.

We don’t often have impressive numbers in early-stage investing; however, we can use some proxy indicators that reflect the value added by a solution, the demand and value it presents to users, and its growth. Technology solutions rarely achieve results on their own but add value to and create efficiencies when they are applied as a component of a larger system.

Our portfolio companies together reach 31.7 million beneficiaries across several industries. We have seen that 20 start-ups from the portfolio have scaled their solution outside their country of origin, of which 11 have scaled to at least 3 new countries. Important for us also that 12 companies that received growth funding, will scale to 25 new countries cumulatively over the funding period – all through close collaboration with UNICEF Country Offices — with 10 more companies being planned for growth funding in 2023.

We see the overall funding landscape rapidly changing for open source solutions as well. In 2004, only nine firms producing open source innovations had raised venture capital funding; however, in 2015, this number had increased to 110, raising over $7 billion from venture capital funds (Accel Partners).

Communities

The Fund’s investment thesis aims to show how venture capital can generate financial and social return while closing asymmetries in opportunity. It is well-known that globally only 2-9% of venture capital (VC) funding goes to female-led companies and in fact this proportion fell further to 2.3% in 2020 from 2.8% in 2019.

Companies in underdeveloped markets benefited from only 4% of the overall VC market in 2019, according to Pitchbook, a percentage that has only feebly increased since then. The Venture Fund has to date invested in companies in 37 countries, exclusively from regions considered UNICEF’s programme countries that broadly encompass developing and emerging markets. We add new countries to our list with every cohort and invest in building entrepreneurial ecosystems to help us achieve our goal of spreading our capital and of showcasing the entrepreneurial and technology talent across geographies. 43% of our portfolio companies are female-led or female-founded - with noteworthy mention that 4 of our 10 top performing companies (by revenue) are led by women.

A commitment to Open Source allows for collaboration at all levels of a company, and technology collaborations have been a hallmark of our portfolio companies. We’ve seen collaborations between startups within our portfolio, such as Weni and Somleng, Weni and Talk2U, and Kotani Pay and Treejer; as well as collaborations between our supported startups and more mature digital public goods such as RapidPro, which has collaborated with Weni and Somleng.

Related Stories